Unlocking Liquidity with Validator-Backed Assets (VBAs)

Exploring Validator-Backed Assets (VBAs) as a new asset class in crypto.

Validator-Backed Asset (VBA) is an emerging asset category within crypto, capturing more than $20 billion in TVL across LSTs, EigenLayer, and additional restaking protocols. The growth of VBAs promotes more secure capital circulating within DeFi and presents an opportunity for the birth of an entirely new asset class, enabling additional growth and capital efficiency for the ecosystem. Ion Protocol is amongst one of the first asset-specific lending platforms built to support VBAs.

Bankless Ventures is proud to back Ion Protocol as its first investment in their $2M pre-seed round co-led by Portal Ventures and SevenX Ventures.

Validator-backed assets (VBAs)

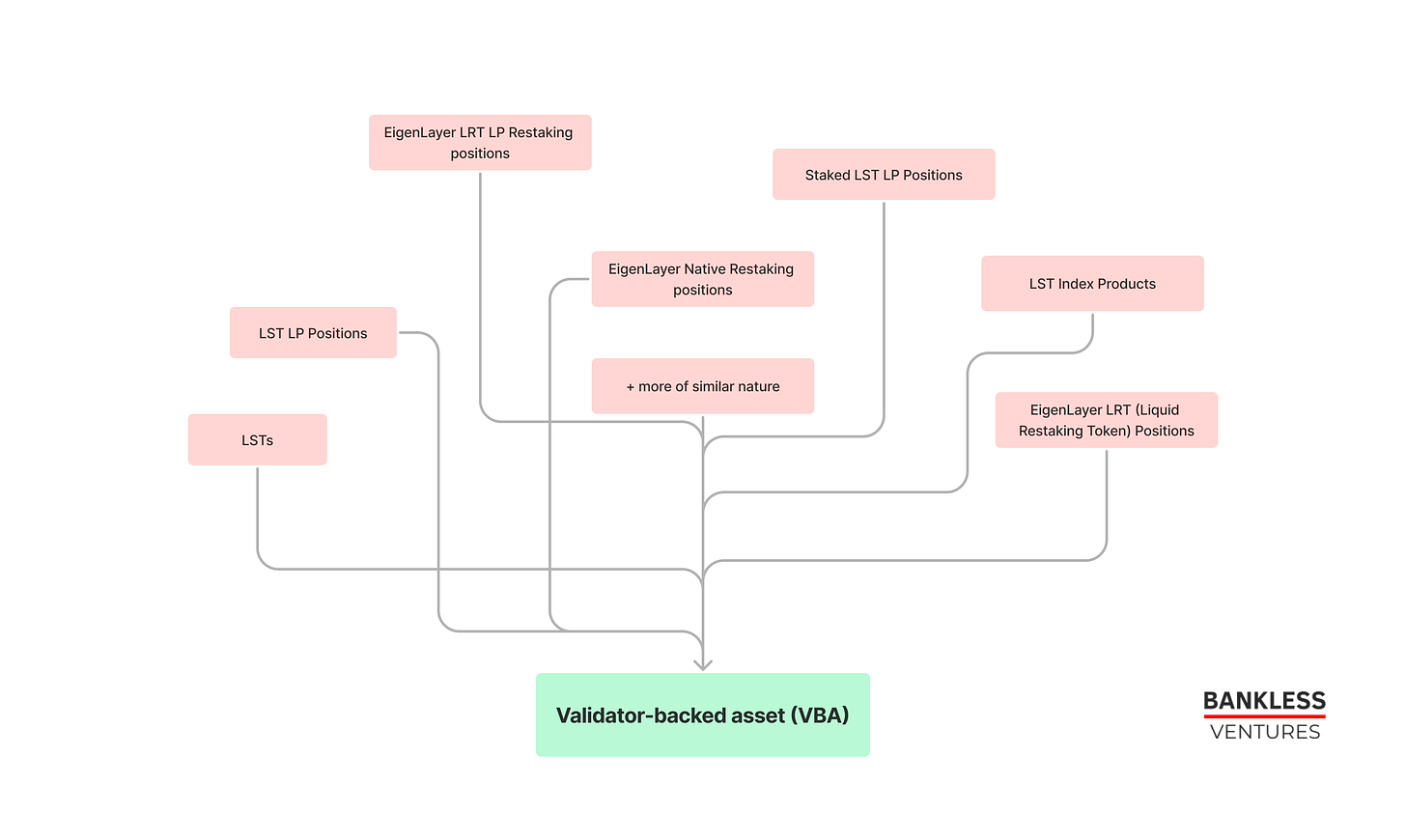

A validator-backed asset is any asset that is backed by value staked in a validator to secure a network. It can range from a standard liquid staking token (LST) to more complex restaked positions. Since each VBA contains a specific risk profile linked to factors outside of those traditionally considered in DeFi products, adding support for them in a composable fashion across DeFi becomes challenging. A few examples of VBAs include:

LSTs (eg. stETH, rETH)

LST LP Positions

Staked LST LP Positions (e.g., Aura Finance’s ERC-4626 positions)

EigenLayer Native Restaking positions

EigenLayer LRT (Liquid Restaking Token) Positions

EigenLayer LRT LP Restaking positions

LST Index Products (e.g., IndexCoop’s $dsETH, UnshETH and more)

Ion Protocol: A lending market for validator-backed assets

Ion Protocol allows users to lend and borrow using validator-backed assets as collateral. It uses provable validator-backed data to calculate credit risk and let users borrow ETH against their VBA.

All loan positions in Ion are price-agnostic, meaning that instead of relying on price oracle data, all the loan parameters such as the interest rates, LTVs, position health, etc. are determined by consensus layer data and secured with ZK data systems. Liquidations on Ion are triggered by changes in consensus layer state, not by price oracles — a novel design to efficiently support VBAs across defi.

Core mechanism designs

Single Market Lending: On Ion, the lending market is isolated to support ETH only– lenders supply ETH as liquidity, offering borrowers access to the most liquid and used asset across defi; ETH. This enables ETH holders to access passive low-risk yields without exposing themselves to the additional trust assumptions associated with participating in validator staking. Borrowers are then able to always borrow ETH to compound their staking yields, hedge staking positions, and more, enabling hyper-efficient lending markets to borrowers.

Staking Sensitive Interest Rates: To make lending more efficient for assets that earn rewards from validators, Ion sets limits on how much interest rates can change compared to the current reward rates of the assets being used as collateral. This helps borrowers who want to make the most of their staked assets by giving them a stable interest rate. It also assures lenders that they're getting the best possible interest rates, based on how much people want to use the collateral assets.

Collateral-Specific Interest Rates: In many lending markets today, the interest you pay for borrowing an asset depends on the specific asset you want to borrow. For example, if you deposit USDC and want to borrow ETH, the interest rate will be different from borrowing WBTC. However, on Ion, things work differently. Here, all assets you use as collateral can only be used to borrow ETH. The interest rates are determined by the type of collateral you deposit. This reflects how risky the underlying validator-backed asset is.

ZKML-based Parameterization: This "credit-risk dependent" parameterization leverages Ion’s zero-knowledge machine learning framework that analyzes consensus layer data and information about validator setups to inform risk adjustment. To learn more about this see ZKML-Supported Risk Underwriting.

Reserve Bolstering Mechanism: Each market on Ion has a characteristic piecewise linear curve that dictates the borrow and supply rate of participants in the market. It is bounded by the staking rate of the given asset. The spread between the borrow and supply rate is what we determine as the "reserve spread." This spread helps create an extra amount of money that the protocol can use to protect the market if a black swan event occurs.

Proof-of-Reserve Backed Liquidations: Liquidations on Ion happen independent of the market price of the collateral. Instead, they happen because of changes in the validators' balances in the beacon chain. If the amount of collateral backing a certain asset in the beacon chain decreases and positions become too risky, those positions will be liquidated. Essentially, liquidations are triggered by changes in the validators' accounts, not by how much the collateral is worth in the market.

Partial liquidation: Instead of having a fixed discount rate for liquidators, Ion uses a sliding scale for this rate. This means that the reward for taking over a risky position increases as the position becomes even riskier. It also limits how much of the collateral can be bought. This limit is designed to help liquidators bring a risky position back to safety without causing extra losses for the borrower.

Feeless flash loans: Ion enables users to take feeless flash loans from the protocol to effectively take uncollateralized borrows that can then be leveraged to perform complex operations (while supporting some internal products) such as position rebalancing, leveraged yield generation, and more. Because fees on borrows are only charged on a per-block basis and there is no additional fee charge incurred by the protocol, flash loans are completely free on Ion and incur no cost to the user (outside of network costs).

Builders behind Ion Protocol

Behind Ion are two passionate and ambitious co-founders, Chunda and Jun, who possess a strong vision for the future. They see ETH staking as the new "risk-free rate" which enables innovation in the defi protocols to support this risk-free rate as a foundational source of revenue in which many financial products can be built on top of.

Chunda McCain | CEO and Co-Founder Linkedin | Twitter

Chunda is a young and ambitious entrepreneur who first discovered an interest in crypto at the age of 12. His interest in the space solidified into a passion during his time at the University of Pennsylvania (UPenn), where he studied Biology and Economics as part of the Life Science and management coordinated dual degree program. At UPenn, Chunda became president of the Penn Blockchain Club and co-founded FranklinDAO, a DAO involved in various activities including governance delegation of approximately $100 million (the second-largest delegate on Aave), producing research content on projects and emerging narratives within web3, and organizing events/network opportunities for students. Chunda's professional journey includes working as a Summer Business Analyst at McKinsey, a Blockchain Developer at Party Round, a core team member at Pentagon, a DeFi company built by the founder of Rari Capital and Waymont, Jai Bhavnani, and a Research Scholar at Blockchain Capital (at the time the firm was leading their EigenLayer deal which inspired Chunda to commit himself full-time to building in the industry). Chunda's passion, drive, and expertise position him as a promising builder and contributor to the future of DeFi.

Jun Kim | CTO and Co-Founder | Linkedin | Twitter

Jun, a former computer science student at UPenn, dropped out in January 2022 to work full-time as CTO of VO2: a Techstars-backed sports-fan engagement company he co-founded. Prior to VO2, Jun gained valuable experience in the industry working as an Engineering Intern at Terraform Labs in 2021 and a Research Scholar at Blockchain Capital in 2022. After leaving VO2, Jun traveled around the world participating in hackathons until deciding to join Chunda as a co-founder.

Jun and Chunda have been close friends for three years and are committed to making Ion a core infrastructure within the DeFi ecosystem. The extended Ion team comprises of 7 additional members; 4 engineers and 3 on the operations, marketing, and business development side.

Timeline

2023 Q4 - Mainnet Launch

Includes LST Support, EL position support, Exotic LST Positions

2024 Q1 - CDP Launch

Launching the CDP + with potential plans for a v2 lending market and L2 expansion

2024 Q2 - Additional products

Expand product offering; Bonds, rate products, etc.

Onwards

Other PoS networks + Ideally Neobank integrations if there is demand, and institutional adoption if demand is there

We’re thrilled to be supporting this team along their journey. To learn more about Ion Check out the Ion docs and follow them on X for updates.

About Bankless Ventures

Bankless Ventures is a $40M early-stage Web3 Venture fund launched in 2023 to empower pioneers to explore the frontier of Web3.

If you want to invest in the Bankless Ventures fund, you can submit an interest form as a Limited Partner (LP):

If you’re a startup that wants to be reviewed by our investment team, show us what you’re building here.

Disclosure

The views expressed here are those of Bankless Ventures, LLC (“Bankless Ventures”) personnel quoted and are not the views of Bankless Ventures affiliates. Certain information contained here has been obtained from third-party sources, including from portfolio companies of funds managed by Bankless Ventures. While taken from sources believed to be reliable, Bankless Ventures has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; Bankless Ventures has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by Bankless Ventures. (An offering to invest in a Bankless Ventures fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Bankless Ventures, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.