Schuman Financial: Bringing European Finance Onchain

Despite the euro’s prominent place on the world stage, a large-scale euro stablecoin has remained elusive. That’s where Schuman Financial comes in. With a mission to bridge this gap, Schuman is building EURØP, a fully compliant, euro-denominated stablecoin backed by robust financial and banking infrastructure.

In this conversation, we speak with Martin, the founder and CEO of Schuman Financial. Beside being a serial tech entrepreneur and investor, Martin was formerly a government minister, member of the board of the European Stability Mechanism, and EVP for Europe at Binance. He also holds an advanced degree in applied economics from Harvard University.

Read on to learn more about their journey, the hurdles of navigating regulatory waters, and what the future of euro-denominated finance might look like.

Bankless Ventures: What was the original spark that led you to start Schuman Financial?

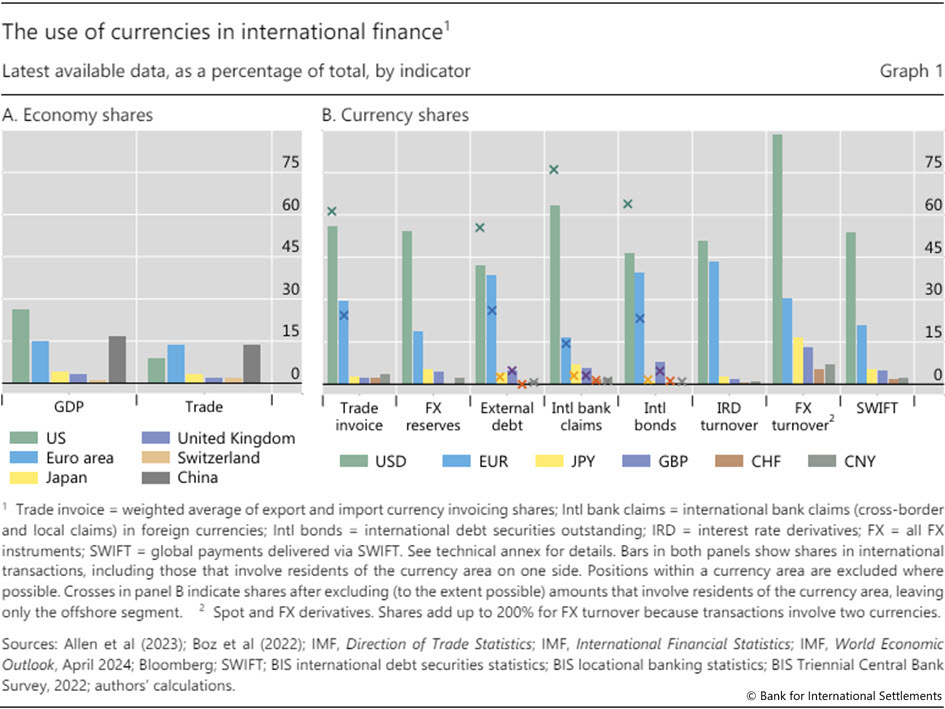

Martin: The euro is by far the second biggest global currency after the dollar, financial services are moving on-chain, and yet there is still no major euro stablecoin. That gap was a glaringly obvious business opportunity for us for many years. Plenty of attempts have been made to build a euro stablecoin, but none of them succeeded because nobody has done it right. So we’ve set out to finally fix that.

Bankless Ventures: What’s the biggest problem you’re solving, and why does it matter?

Martin: Europe has an economy with more than 400 million people, and everybody here operates on euros, not dollars. There is no chance it will dollarise anytime soon. The euro-denominated financial market is and will remain the second largest in the world. So if you believe these financial services will also inevitably move on-chain in the coming years–simply because blockchain is just a better technology for storing and moving financial value than anything we’ve had before–then a euro stablecoin market going into hundreds of billions of dollars is inevitable. The only way to settle and transact with euro-denominated financial services on-chain is via a major euro stablecoin. It doesn’t make any sense to settle them against euro fiat, let alone stablecoin dollars. And it’s not just the stablecoin itself–there is a whole infrastructure and interconnections into the traditional financial and fiat systems that you need to build around the stablecoin.

Bankless Ventures: Talk to me about Schuman in more detail, how does it work? How do you interact with it?

Martin: Schuman Financial is the company building the biggest euro-denominated stablecoin and the required infrastructure for moving European and euro-denominated financial services on-chain. Our core initial product is our euro stablecoin, EURØP. We are issuing it through a French company with a MiCA stablecoin issuer license in France which is effectively regulated by the French central bank. We also have the best fiat and banking infrastructure, including Societe Generale as our main banking partner. With this, we can receive payments from our clients going into tens of millions of euros and convert them into stablecoins that they receive in their wallet in less than a minute from when they send them to us.

Institutional clients can mint and burn the stablecoin directly with us, while retail clients will shortly be able to buy at all the main crypto exchanges in Europe. They can then use it for all the usual crypto purposes, including trading, and for more traditional financial services, like payments, remittances, lending and investing in tokenised real-world assets.

Bankless Ventures: How has your vision for the product evolved since you first started working on it?

Martin: Initially, the focus was purely on creating a compliant euro stablecoin, but we realised that the stablecoin alone wasn’t enough. The ecosystem and infrastructure around EURØP have to be just as strong–both in crypto and in TradFi, like the banking and payments services that I’ve mentioned previously. We are increasingly focusing on building these capabilities that will enable more traditional financial services but be much more effective because they will be on-chain.

Bankless Ventures: What has been the most surprising challenge you've faced so far in building this company?

Martin: One of the biggest challenges has been regulatory compliance. Even though MiCA provides clarity, navigating the challenges of compliance, banking, and institutional onboarding has been more difficult than expected. Traditional financial institutions still view stablecoins with scepticism despite the apparent benefits, although we can see that their position on stablecoins is shifting. If your readers are interested in this topic, I’ve explained the rationale in a recent blog.

Bankless Ventures: Can you share a moment where you knew you were on the right track—when something just clicked?

Martin: A few months after we started, a major crypto exchange told us, “Guys, we have been believing in the euro stablecoin potential for years but couldn’t find one that ticked all our boxes. So we’re pretty excited that you are finally building something we can get behind.”

Bankless Ventures: What role does community play in your company’s growth and vision? How can people get involved?

Martin: Unlike traditional finance, crypto is driven by users, developers, and businesses that build on top of stablecoin infrastructure, and community is critical for success. We actively engage with DeFi protocols, fintechs, and institutional players to expand EURØP’s use cases. People can get involved by integrating EURØP into their projects, advocating for adopting euro-based stablecoins, or simply using it and spreading the word.

Bankless Ventures: What excites you most about the future of the industry, and where does your company fit into that vision?

Martin: The future of finance is on-chain. The transition from slow, inefficient and often expensive banking systems and financial products to faster, cheaper and much more accessible financial products running on a blockchain is inevitable. And we can now finally see it in action, like with our yet-to-be-announced cross-border payment product. A payment from a US bank account to a bank account in Europe that takes a few days with the current banking system but less than a few minutes with our stablecoin solution is actually pretty cool.

Bankless Ventures: If you could go back and give yourself one piece of advice on day one, what would it be?

Martin: Who would have thought, but it turns out that regulated finance moves way slower than crypto. So brace yourself with patience and just keep building.

Bankless Ventures: What kind of people thrive at your company?

Martin: People who are builders with a positive mindset and can deal with a lot of uncertainty and complexity. We are in a space that combines the revolutionary spirit of crypto with the dry bureaucracy of traditional finance–it takes a lot of resilience to handle that.

Bankless Ventures: What’s the most contrarian belief you hold about building a startup?

Martin: Don’t work like a maniac, and get a lot of sleep. No matter how hard you work, you will not succeed unless you have the best ideas and make the right strategic decisions. And to make those, you need a clear mind, which you will never get if you are constantly submerged in your daily grind.

Bankless Ventures: Who or what has been most influential in shaping how you run the company?

Martin: CZ. He’s probably the most impressive founder and CEO that I’ve ever worked with closely. People in crypto know him as a true visionary, but he also had an incredible and relentless focus on execution and efficiency. Building a great company is ultimately about getting things done exceptionally well and fast.

EURØP is now live on Kraken and Bitvavo!

About Bankless Ventures

Bankless Ventures is an early-stage Web3 Venture fund launched in 2023 to empower pioneers to explore the frontier of web3. We’ve just officially started raising for Fund II. If you want to invest in Bankless Ventures Fund II, you can submit an interest form as a Limited Partner (LP):

If you’re a startup that wants to be reviewed by our investment team, show us what you’re building here:

Disclosures

Views expressed in blog posts are those of the individual personnel of Bankless Ventures, LLC (“Bankless Ventures”) quoted therein and are not the views of Bankless Ventures or its affiliates. Bankless Ventures is not currently registered as an investment adviser with the Securities and Exchange Commission, in reliance on the exemption from registration provided by Section 203(m) of the U.S. Investment Advisers Act of 1940, as amended, and Rule 203(l)-1 thereunder. Blog posts are not directed to any investors or potential investors, and do not constitute an offer to sell, or a solicitation of an offer to buy, any securities, and may not be used or relied upon in evaluating the merits of any investment. These disclosures apply to all blog posts, whether available on this website, any associated distribution platforms, and/or any public online social media accounts, platforms, or sites (collectively, “content distribution outlets”).

Blog posts are provided for informational purposes only, and should not be relied upon or construed as legal, business, investment, tax, or other advice. You should consult your own advisers as to those matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in blog posts are subject to change without notice and may differ or be contrary to opinions expressed by others. Charts, graphs, and graphics provided in blog posts are for informational purposes solely and should not be relied upon when making any investment decision. Certain statements contained here have been provided by third parties or based on information received from third parties, including from portfolio companies of funds managed by Bankless Ventures. While taken from sources believed to be reliable, Bankless Ventures has not independently verified the accuracy or completeness of such statements and information and makes no representations about the accuracy or completeness of the statements or information or their appropriateness for a given situation. In addition, blog posts may include third-party advertisements; Bankless Ventures has not reviewed such advertisements and does not endorse any advertising content contained therein. All blog posts speak only as of the date indicated.

References to any securities or digital assets on this website or any other content distribution outlets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services, or an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, or any other type of recommendation or advice with respect to any securities or assets. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors in any investment vehicle discussed or mentioned by Bankless Ventures personnel, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by Bankless Ventures. An offering to invest in a fund managed by Bankless Ventures will be made separately and only pursuant to the private placement memorandum, subscription agreement, and other relevant documentation of any such fund which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters.

There cannot be any assurances that the investment objectives of Bankless Ventures will be achieved or that its investment strategies will be successful. Any investment in a vehicle managed by Bankless Ventures involves a high degree of risk including the risk that the entire amount is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Bankless Ventures, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. Past performance is not indicative of future results. With respect to its investments in any cryptocurrency or token project, Bankless Ventures is acting in its own financial interest, not necessarily in the interests of other token holders. Bankless Ventures does not have any special role in any of these projects or power over their management. Bankless Ventures does not undertake to continue to have any involvement in these projects other than as an investor and token holder, and other token holders should not expect that it will, or rely on Bankless Ventures to, have any particular involvement.

Blog posts are subject to the Substack Terms of Use and Privacy Policy.