Nocturne: How stealth addresses power private account abstraction

Nocturne is a protocol that combines account abstraction with zero-knowledge proofs and stealth addresses to create “private accounts” — the next step in onchain privacy.

You’ve likely heard about account abstraction in recent times as more development unfolds to simplify onchain activities for end users. This design has unlocked mental models for thinking about privacy onchain in a user-friendly way that has little to no learning curves.

Nocturne Labs is accelerating onchain privacy using a combination of account abstraction, zero-knowledge proofs, and stealth addresses to create what they call “private accounts.” Imagine your normal Ethereum account, where you deposit funds, receive payments, and transact with new protocols. This is what Nocturne private accounts allow for— but with built-in asset privacy.

At Bankless Ventures we’re especially excited about Nocturne’s design and are thrilled to back the team in their $6M seed round alongside Vitalik Buterin, Polychain, Robot Ventures, Hack VC, Bain Capital, and others.

Nocturne’s Protocol Design

Private accounts

As a concept introduced by Nocturne, Private accounts let you perform onchain activities without others knowing who did what– all from a regular Ethereum account. Want to purchase a new meme coin on a DEX without everyone knowing about it? Private accounts are your friends here. Historically, to conduct a private transaction, one might have first withdrawn funds to a CEX or used something like tornado cash, both of which have trade-offs.

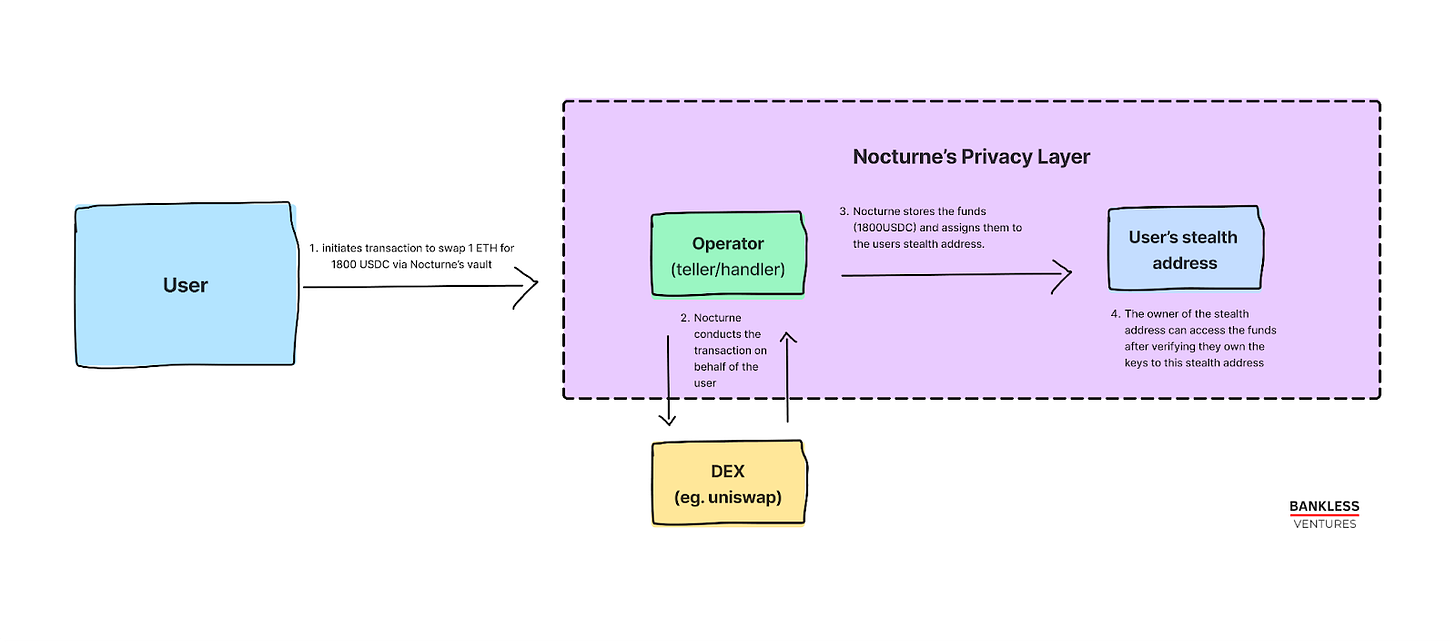

Nocturne is the protocol that powers private accounts on Ethereum. Users have “internal” accounts within Nocturne where receiving/spending funds from these accounts works anonymously (not all tied back to the same address). Users can deposit or receive payments into their Nocturne account anonymously. They can then prove (in zero-knowledge) that they own such funds and use them for arbitrary transactions (e.g. paying a friend, swapping on a DEX, staking on Rocket Pool, etc).

Simplified user flow:

What are stealth addresses?

Stealth address schemes allow users to have a single private key that controls many ephemeral, one-time addresses. Nocturne employs its own stealth address scheme where a user’s “account” is simply the collection of all their stealth addresses (each of which presumably holds some assets).

Example: John needs to send 1 ETH to Chris without letting everyone know that Chris is the one getting the money. John also wants to do this without talking to Chris first. To make this work, we need a system where John can create single or multiple addresses that belong to Chris, but no one else can tell that they're Chris. Nocturne’s stealth address scheme allows for this in an easy, non-interactive manner.

Stealth addresses meet shield pools

A shielded pool enables the accounting and spending of funds without revealing their owners. Users deposit funds into a shielded pool, producing a “note” in return that represents the users’ claim to their funds. The main fields on a note are the token address, the amount of tokens the note contains, and an “identifier” (address) for the owner. To spend the funds contained in the note, the user must prove in zero-knowledge that they have the key corresponding to the owner field in the note. Learn more about Shield Pools here.

The combination of stealth addresses and shield pools enables Nocturne to offer secure and composable private accounts.

Team behind Nocturne

The founding team of Nocturne consists of Luke, Sebastien, and Daniel. Luke was previously an engineer at Celo and one of the founding developers of Nomad, the cross-chain bridge. Sebastien was previously a research engineer at Proxima Labs who contributed significantly to Polygon Zero’s plonky2 proof system during his work on verifiable data flows. Daniel was previously a backend developer at Gemini who developed much of their core institutional APIs. Additionally, Wei Dai, cryptography researcher and partner at 1kx, is a founding advisor to the project.

Roadmap

Nocturne’s v1 protocol is mostly completed. The protocol has undergone two audits from Trail of Bits and Zellic collectively. The team plans to launch on mainnet in Q4 2023 and will make the product available via their private vault UI.

We are thrilled to be supporting this team along their journey. To learn more about Nocturne Check out the Nocturne docs and follow them on X for updates.

About Bankless Ventures

Bankless Ventures is a $40M early-stage Web3 Venture fund launched in 2023 to empower pioneers to explore the frontier of Web3.

If you want to invest in the Bankless Ventures fund, you can submit an interest form as a Limited Partner (LP):

If you’re a startup that wants to be reviewed by our investment team, show us what you’re building here.

Disclosure

The views expressed here are those of Bankless Ventures, LLC (“Bankless Ventures”) personnel quoted and are not the views of Bankless Ventures affiliates. Certain information contained here has been obtained from third-party sources, including from portfolio companies of funds managed by Bankless Ventures. While taken from sources believed to be reliable, Bankless Ventures has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; Bankless Ventures has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by Bankless Ventures. (An offering to invest in a Bankless Ventures fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by Bankless Ventures, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.